|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

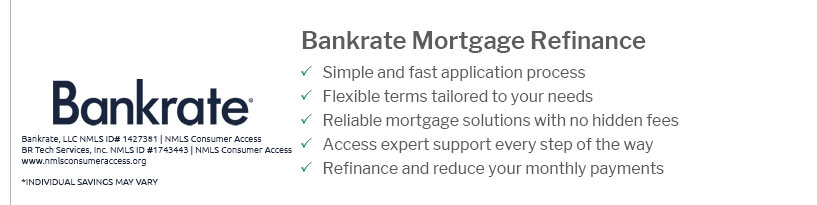

Understanding What Does a Refinance Cost: Key Insights and ConsiderationsRefinancing a mortgage can be an excellent way to save money or adjust the terms of your loan. However, it's important to understand the various costs associated with refinancing to ensure it aligns with your financial goals. Major Components of Refinance CostsLoan Origination FeesLoan origination fees are typically charged by lenders for processing the new loan. These fees can range from 0.5% to 1% of the loan amount. It's essential to shop around and compare different lenders to find the best deal. Appraisal FeesAn appraisal is usually required to determine the current market value of your home. The cost for an appraisal can vary but typically ranges between $300 and $600. Title Insurance and Settlement FeesTitle insurance protects against any claims on the property. Settlement fees, on the other hand, cover the cost of finalizing the refinance. Combined, these fees can range from $700 to $1,500. Additional Costs to ConsiderDiscount PointsDiscount points are optional fees paid to reduce the interest rate on your loan. Each point costs 1% of the total loan amount and can lower your monthly payments. Prepayment PenaltiesSome loans come with prepayment penalties for paying off your existing mortgage early. Be sure to check your current mortgage agreement for any such clauses. Is Refinancing Worth the Cost?Deciding whether to refinance depends on your unique financial situation. It's crucial to calculate the break-even point-the time it will take for your savings to cover the refinance costs. For more detailed insights, visit average closing costs refinance home loan. Understanding Cost VariationsThe cost of refinancing can vary significantly based on several factors, including your location, loan amount, and credit score. Conducting thorough research and comparing offers from different lenders is essential. Comparing Different Lenders

For more information, explore average cost to refinance your home to better understand the potential expenses involved. FAQWhat is the average cost to refinance a mortgage?The average cost to refinance a mortgage typically ranges from 2% to 5% of the loan amount. This can vary based on your location and lender. Can I refinance without closing costs?Yes, some lenders offer 'no closing cost' refinances. However, these often come with higher interest rates or are rolled into the loan balance. https://www.freedommortgage.com/learning-center/articles/cost-to-refinance

It can cost between 2% and 6% of the loan amount to refinance a conventional loan. These refinances can have higher credit and financial requirements compared ... https://www.lendingtree.com/home/refinance/how-much-does-it-cost-to-refinance/

Common mortgage refinance fees ; Origination fee, Up to 1.5% of loan amount ; Credit report fee, $10 to $100 per applicant ; Document preparation fee, $50 to $600. https://money.usnews.com/loans/mortgages/articles/is-refinancing-a-mortgage-expensive

How Much Does It Cost to Refinance a Mortgage? ... On average, homeowners can expect to pay 2% to 6% of the loan amount to refinance a mortgage.

|

|---|